Unlock Editor’s Roundup for free

Roula Khalaf, editor of the FT, selects her favorite stories in this weekly newsletter.

The eurozone is set for a much-needed economic boost on Thursday, when the European Central Bank is expected to start cutting interest rates for the first time in almost five years.

The extent of the boost will depend on how much further borrowing costs fall, but stubbornly high inflation fueled by rapid wage growth could limit the number of rate cuts, analysts say.

With markets regarding a first rate cut as a given, investors will be eagerly looking for clues from ECB President Christine Lagarde on the future path of monetary policy.

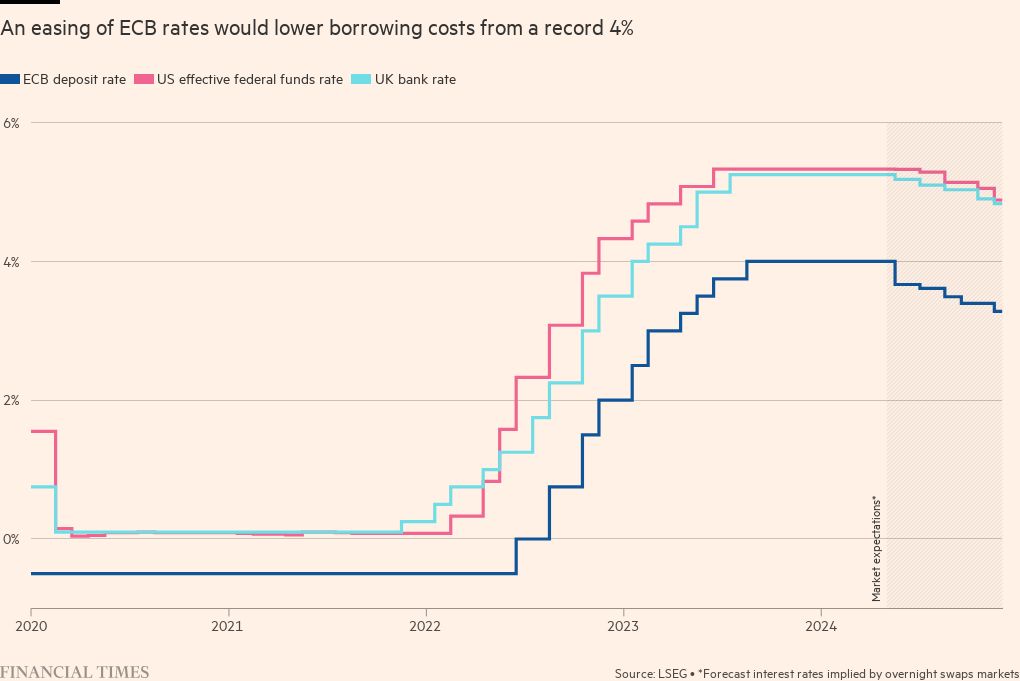

By starting to cut rates again, the bank is determined to breathe new life into the housing, business investment and consumer spending markets. The ECB raised its key deposit rate last year to a record 4 percent, putting a damper on economic activity to deal with the biggest rise in prices in a generation.

“Lower rates matter,” said Holger Schmieding, chief economist at Germany’s Berenberg bank. “Financial markets are well aware that this is coming, but news that the ECB has started to cut rates may be [the] attention of families and businesses, and increase sentiment.”

The Eurozone economy already showed preliminary signs of a recovery in the first three months of this year, when gross domestic product in the bloc rose 0.3 percent from the previous quarter – ending a year of stagnation.

The pick-up in growth mostly reflected the fading of a shock to energy and food prices caused by Russia’s full-scale occupation of Ukraine and an increase in global trade, Schmieding said.

But he added that the prospect of a rate cut had also helped lower the cost of mortgages and corporate loans. “This will lead to a downturn in housing markets, a recovery in homebuilding and should help investment rebound, as we expect this year.”

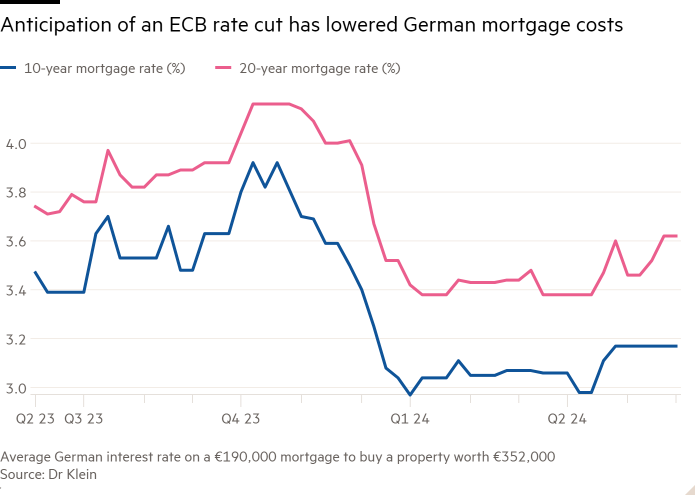

In Germany, house prices fell 10 percent after the ECB began raising rates in 2022. But they are stabilizing this year as 10-year mortgage rates fell from almost 4 percent last October to below 3.2 percent, according to the broker. of Dr Klein mortgages. .

“The more favorable interest rates since then have led to a marked increase in demand for mortgage finance and the market has experienced significant growth since then,” said Michael Neumann, head of private clients at Dr Klein.

Marc van der Lee at the Dutch Association of Estate Agents predicted that house prices in the Netherlands would rise to record levels in the second quarter, mainly reflecting rising wages and housing shortages, but also lifted by lower housing costs. mortgages.

As for further moves after Thursday’s meeting, the problem for Lagarde is that the steady decline in inflation from its peak of more than 10 percent in 2022 has been halted. Data released last week showed that annual price growth accelerated again to 2.6 percent in May from 2.4 percent a month earlier.

The eurozone’s unexpectedly strong labor market is also keeping price pressures high, with collective wage growth rebounding to a record pace of 4.7 percent in the first quarter and unemployment in the bloc falling to a new low. of 6.4 percent in April.

Most economists think the recent strong data means the ECB will need to slightly raise its inflation forecast of 2.3 percent for this year and its GDP growth forecast of 0.6 percent. .

Combined with signs that the Federal Reserve is unlikely to start cutting rates for several months — if at all this year — as a result of a strong U.S. economy, investors have trimmed their bets to less than three-quarters of a point. by the ECB this year. year.

The timing of this week’s rate cut will be unusual for the ECB, because it usually only initiates such monetary easing in response to a crisis, such as after the collapse of Lehman Brothers in 2008 or when Greece needed a series bailouts in 2011.

Even the ECB’s last rate cut in September 2019 was a reaction to weakening growth and falling inflation below its 2 percent target.

“They are moving into an improving situation, rather than a worsening one,” said Paul Hollingsworth, chief European economist at French bank BNP Paribas. “This means they will be in no rush to cut rates further, which makes another cut in July unlikely and leads them to only cut once a quarter.”

Influential members of the ECB’s rate-setting governing council have already hinted they expect a gradual pace of easing, with just two more rate cuts possible this year.

The ECB’s chief economist, Philip Lane, told the Financial Times last month that rates were likely to “decline somewhat” during the year while remaining in “containment territory”, which most economists assume means remaining above 3 percent.

Dutch central bank chief Klaas Knot said at an event in London last week that based on the ECB’s latest forecasts, its models showed that “optimal policy would have been broadly consistent with three to four rate cuts ” until the end of the year.

For inflation to fall to the ECB’s 2 percent target by next summer, it is counting on a combination of slowing wage growth, rising worker productivity and shrinking company profit margins.

If those trends fail to materialize and inflation remains uncomfortably high, Hollingsworth said rate-setters “may have to hold back after the first couple of cuts.”

Faced with such uncertainty over the economic outlook, Lagarde is widely expected to hold back by giving plenty of hints on the likely path of policy, allowing the bank to retain maximum flexibility on the extent of rate cuts for as long as possible. .

#ECB #rate #cut #give #life #Eurozone #economy

Image Source : www.ft.com