Hang Seng Index: Improvement in market breadth and southward flows, bull run may not be over

- Hang Seng Index component stocks trading above their respective 200-day moving averages have risen steadily in the past three months.

- A positive net inflow trend from mainland Chinese investors and traders has developed into the Hong Kong stock market.

- The China Caixin Services PMI has continued to advance in May, reducing the chances of a deflationary risk spiral taking root in China.

- Look at key intermediate-term support at 17,110 in the Hang Seng Index.

This is a follow-up analysis of our previous report“Hang Seng Index: Positive animal spirits led by oversold overshadow currency war risk” dated May 10, 2024. Click here for a summary.

Since April’s stellar performance that delivered a positive monthly return of 7.39% for the Hang Seng Index along with a similar feat seen in the Hang Seng Technology Index (+6.42%) and the China Hang Seng Enterprise Index Seng (+7.97) which outperformed the US S&P 500 (-4.16%) and the rest of the world; MSCI All Country World Index (-3.55%), fortunes have reversed in May.

The Hang Seng index managed to squeeze out only a meager monthly return of 1.78% through the end of May (down from a high-water intra-month return of 10.94%), which underperformed the S&P 500 (+4.80%) and the MSCI All World Country Index (+4.58%) in May.

Is the bull run over for the Hang Seng Index?

Market breadth has improved for the Hang Seng Index

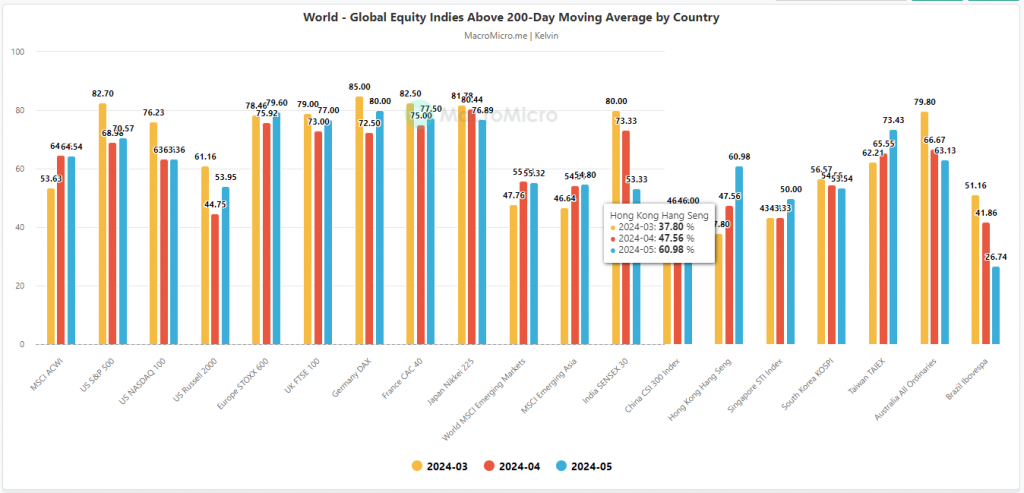

Fig 1: Market breadth gauges of global equity indices to end May 2024 (Source: MacroMicro, click to enlarge chart)

Using the 200-day moving average as a gauge to assess the status of a major trend phase, we examine the number of component stocks expressed as a percentage of the Hang Seng Index that trade above their respective 200-day moving averages; an indication of a stronger phase of the main uptrend if more constituent stocks are trading above their 200-day moving averages.

As of March 2024, the percentage of Hang Seng Index component stocks above their respective 200-day moving averages stood at 37.80% and has gradually increased in the following two months; April (47.56%) and May (60.98%). A similar positive observation, albeit of a shallower magnitude, can be seen in the China CSI 300 Index; March (39.33%), April (46%) and May (46%) (see Fig. 1).

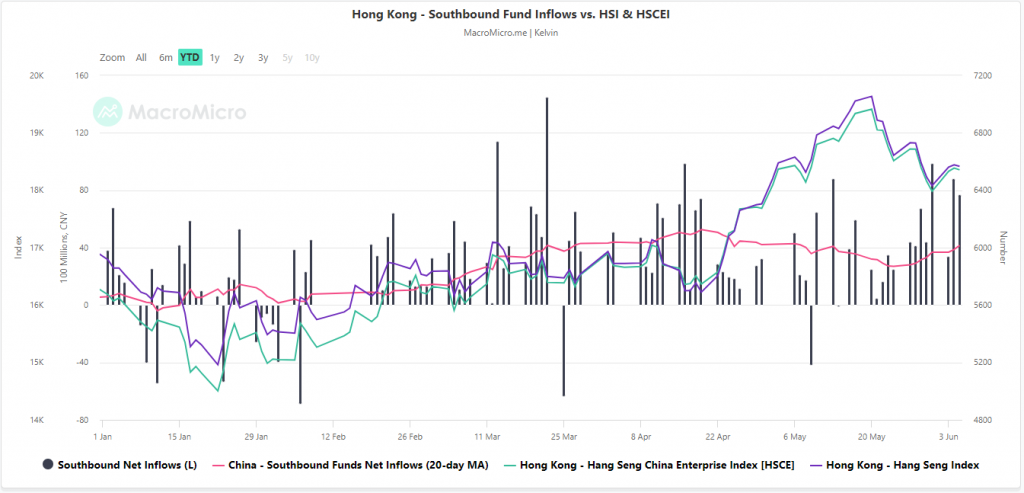

Fund inflows to southern China have trended higher since late May

Fig 2: China’s Net Southward Flows with HSI & HSCEI as of June 5, 2024 (Source: MacroMicro, click to enlarge chart)

China/onshore investment linked to Hong Kong stocks goes through the Shanghai and Shenzhen-Hong Kong Stock Connect Programs. The total flows from these two programs are known as fund flows to the south.

A positive upward trend in net southward flows indicates that mainland Chinese investors and traders are likely bullish on the outlook for Hong Kong’s stock market, fueling overall positive momentum in the Hang Seng Index, which is moving almost in line with a southerly direction trend. net inflows of funds.

The trend of net inflows to the south has started to move higher since May 27, 2024, as indicated by the rise in the 20-day moving average (see Fig 2) suggesting increased confidence and optimism towards Hong Kong stocks.

Macro data improved in China

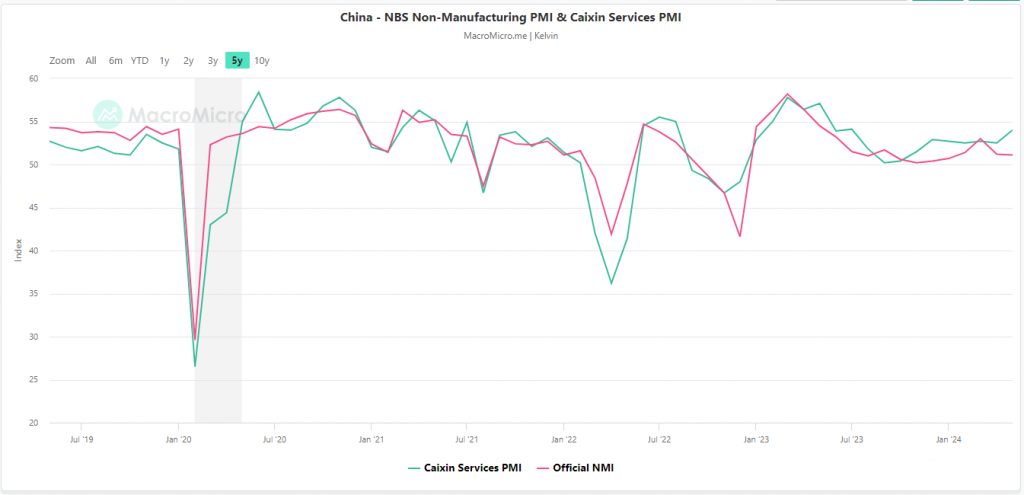

Fig 3: China NBS Non-manufacturing PMI & Caixin Services PMI for May 2024 (Source: MacroMicro, click to enlarge chart)

The latest data from China’s Caixin Services Purchasing Managers’ Index PMI represents small and medium-sized private enterprises (as opposed to the official NBS non-manufacturing PMI which consists of large state-owned enterprises) that have been in a sustainable expansion path from October 2023; it advanced to 54.0 in May from 52.5 printed in April, beating forecasts of 52.6 and registering its fastest pace of expansion since July 2023 (see Fig. 3).

Additionally, its new business and new export orders (sub-components of the China Caixin Services PMI) for May rose the most in a year due to strengthening domestic and external demand.

This latest set of positive macro data suggests that partial stimulus measures by China’s top policymakers are working to negate the deflationary risk spiral that has been caused by the significant natural slowdown in the domestic property market.

The Hang Seng index has returned to the upside of its 50-day moving average

Fig 4: Medium-term trend of the Hang Seng Index since June 5, 2024 (Source: TradingView, click to enlarge the chart)

Last two weeks down 8.3% from the May 20, 2024 high of 19,706 on the Hang Seng Index, it has almost reached the 50-day moving average which is acting as an intermediate support at around 17,930.

Moreover, the daily RSI momentum indicator has managed to show a bounce directly above a key parallel support at the 42 level, which suggests that medium-term bullish momentum may have re-emerged (see Fig 4).

Watch key medium-term support 17,110 (also close to 200-day moving average) to maintain the current medium-term uptrend phase for the next medium-term resistance to reach 20,400 (also the upper boundary of the rising channel instead of the low of January 22, 2024).

However, a breakout with a daily close below 17,110 damages the medium-term phase of the uptrend to expose future medium-term support at 16,055 on the first step.

The content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you wish to reproduce or redistribute any of the content found on MarketPulse, an award-winning forex, global commodities and indices service and news site service produced by OANDA Business Information & Services, Inc., please use the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to learn more about the pulse of global markets. © 2023 OANDA Business Information & Services Inc.

#Hang #Seng #Index #Improvement #market #breadth #southward #flows #run #MarketPulse

Image Source : www.marketpulse.com